Comprehensive Guide to End-of-Service Benefits in Saudi Arabia

End-of-Service Benefits in Saudi Arabia

A Comprehensive Guide to End-of-Service Benefits in Saudi Arabia

End-of-service benefits (EOSB) represent a critical aspect of Saudi labour law, providing financial security for employees upon termination of employment. This comprehensive system ensures that workers receive compensation proportional to their length of service, acting as a safety net in the job market. However, understanding EOSB regulations can be challenging, as they are often subject to updates and amendments. For employers to remain compliant and employees to protect their financial future, a thorough understanding of EOSB is essential.

What are End-of-Service Benefits?

End-of-service benefits (EOSB) are financial compensations provided to employees by their employers upon the termination of their employment contracts. These benefits are mandated by labour laws in many countries and are designed to provide employees with financial security and assistance as they transition out of their jobs. In Saudi Arabia, EOSB is governed by the Labour Law, which outlines the rights and obligations of employers and employees regarding EOSB. End-of-Service Benefits in Saudi Arabia are fundamental to employment regulations aimed at protecting workers’ rights and ensuring fair treatment upon termination of employment.

What is Included in EOSB?

As per Article 2 of Saudi Labour Law, all the fixed benefits paid to an employee are included in the end-of-service benefits calculation, such as:

- Basic Salary

- Housing

- Transportation

- Mobile Allowance

However, benefits contingent upon other factors, such as sales incentives, ticket allowance, and bonuses, are not included in the calculation.

Eligibility for End-of-Service Benefits in Saudi Arabia

In Saudi Arabia, end-of-service benefits (EOSB) are available to both Saudi nationals and expatriate workers covered under the country’s labour laws. Generally, any employee who has completed a certain period of continuous service with an employer is entitled to EOSB upon termination of their employment contract, whether due to resignation, retirement, or dismissal. Nationality does not affect EOSB eligibility if the employee meets the minimum service requirements, which may vary depending on some factors, such as:

Minimum Service Requirements

Minimum service requirements stipulate the duration an employee must work for an employer to qualify for EOSB. In Saudi Arabia, these requirements are typically outlined in labour laws and can vary depending on factors such as the type of employment contract and industry standards. Generally, employees must complete a minimum period of continuous service to be eligible for EOSB.

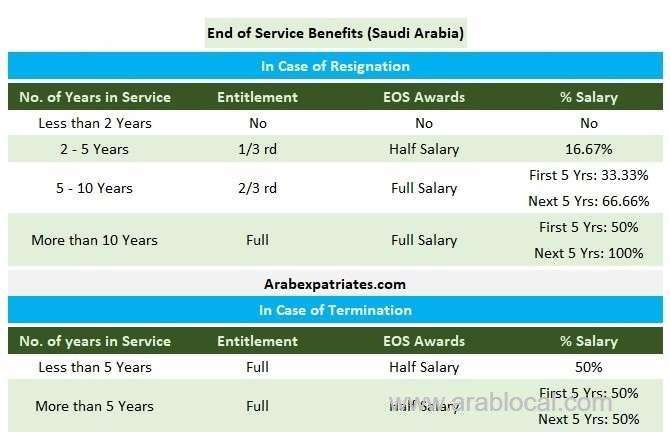

Termination:

If the employment is terminated by the employer (except for misconduct):

- Less than one year: No benefit shall be paid.

- 2-5 years: Half salary per month per year shall be paid.

- 5+ years: Full benefit shall be paid.

Resignation:

The eligibility for benefits upon resignation is stricter. However, the amount you receive depends on the duration of your service:

- Less than two years: No benefit shall be paid.

- 2-5 years: One-third of the total benefit.

- 5-10 years: Two-thirds of the total benefit.

- 10+ years: Full benefit.

Termination Scenarios

The reason your employment ends also plays a role:

- Termination by the Employer (no misconduct): The employee needs to meet the minimum service requirement, and the amount received depends on the duration.

- Termination by the Employer (due to misconduct): The employee generally forfeits their EOSB if the termination, as specified in their employment contract.

- Mutual Agreement: If the employee and the employer agree to end the employment, the employee is typically entitled to EOSB based on their mutual agreement terms.

Resignation Under Article 87

Article 87 of Saudi Labour Law states that the following employees will also get a total EOSB award:

- A female employee who resigns within 6 months of marriage.

- A female employee who resigns within 3 months of becoming a mother.

- An employee who resigns due to a natural disability.

- In case of death of an employee.

Resignation at Contract Completion

If an employee resigns at the contract completion, they are entitled to their full end-of-service benefits award, i.e.

- 1/2 salary per annum for the first 5 years.

- Full salary per annum after the first 5 years.

In other words, the EOSB will be calculated in the same way as if the employee was terminated.

Resignation Within 2 Years = ZERO

According to Article 85 of Saudi Labour Law, if an employee resigns within 2 years of resignation without completing their contract, they are not entitled to any end-of-service benefits.

Resignation Between 2 to 5 Years

According to Article 85 of Saudi Labour Law, if an employee resigns after 2 years but before completing 5 years of service:

- They are entitled to 1/3rd of their EOSB award.

- EOSB Award: Half salary for each year.

How are End-of-Service Benefits Calculated?

Calculations of End-of-Service Benefits in Saudi Arabia are anchored on two fundamental factors: the “half-month salary rule” and the length of service. These elements are pivotal in determining the compensation employees receive upon the termination of their employment contracts. Here’s a breakdown:

Half-Month Salary Rule

According to Saudi labour law, employees with unlimited-term contracts are entitled to gratuity equivalent to half a month’s salary for each of the first five years of service, followed by one month’s salary for each subsequent year. For employees with limited-term contracts, gratuity is calculated based on the duration of their contract. This formula provides a structured approach to EOSB calculations, with the compensation amount tied directly to the employee’s length of service.

Length of Service

An employee’s service duration is a crucial determinant in EOSB calculations. In Saudi Arabia, the length of service refers to the total period of continuous employment with the same employer. This includes full years and additional months worked beyond a complete year. The longer an employee has served, the higher their entitlement to EOSB. Consequently, employees with lengthier tenures receive more substantial EOSB payments, reflecting their dedication and contribution to the organisation over time.

Example Calculations

Let's consider some examples to illustrate how End-of-Service Benefits in Saudi Arabia are calculated based on the “half-month salary rule” and the length of service:

1 Year of Service

- Resigned: No EOSB.

- Terminated: No EOSB.

2 Years of Service

- Resigned:

- Monthly Salary: 10,000 SAR

- EOSB = (0.5 * 10,000 * 2) / 3 = 3,333.33 SAR

- Terminated:

- Monthly Salary: 10,000 SAR

- EOSB = 0.5 * 10,000 * 2 = 10,000 SAR

4 Years of Service

- Resigned:

- Monthly Salary: 10,000 SAR

- EOSB = (0.5 * 10,000 * 4) / 3 = 6,666.67 SAR

- Terminated:

- Monthly Salary: 10,000 SAR

- EOSB = 0.5 * 10,000 * 4 = 20,000 SAR

7 Years of Service

- Resigned:

- Monthly Salary: 10,000 SAR

- EOSB for first 5 years: (0.5 * 10,000 * 5) / 3 = 8,333.33 SAR

- EOSB for next 2 years: (10,000 * 2) * (2/3) = 13,333.33 SAR

- Total EOSB = 8,333.33 + 13,333.33 = 21,666.67 SAR

- Terminated:

- Monthly Salary: 10,000 SAR

- EOSB for first 5 years: 0.5 * 10,000 * 5 = 25,000 SAR

- EOSB for next 2 years: 10,000 * 2 = 20,000 SAR

- Total EOSB = 25,000 + 20,000 = 45,000 SAR

11 Years of Service

- Resigned:

- Monthly Salary: 10,000 SAR

- EOSB for first 5 years: (0.5 * 10,000 * 5) = 25,000 SAR

- EOSB for next 6 years: (10,000 * 6) * (2/3) = 40,000 SAR

- Total EOSB = 25,000 + 40,000 = 65,000 SAR

- Terminated:

- Monthly Salary: 10,000 SAR

- EOSB for first 5 years: 0.5 * 10,000 * 5 = 25,000 SAR

- EOSB for next 6 years: 10,000 * 6 = 60,000 SAR

- Total EOSB = 25,000 + 60,000 = 85,000 SAR

What are the Different Types of End-of-Service Benefits in Saudi Arabia?

EOSB encompasses various forms of financial compensation provided to employees upon the termination of their employment contracts. The main two types of EOSB in Saudi Arabia include:

End-of-Service Gratuity

This is the core financial compensation mandated by law. As discussed previously, it’s calculated based on monthly salary and total service years. The half-month salary rule for the first five years and the full-monthly salary rule for subsequent years determine the gratuity amount.

Accrued Leave Pay

Employees in Saudi Arabia are entitled to annual leave days as per labour regulations and their employment contracts. Employees who do not utilise their allocated annual leave days during their employment are entitled to receive payment for the unused days upon termination of their contracts. The calculation of accrued leave pay typically involves multiplying the number of unused leave days by the employee’s daily wage or salary rate. Accrued Leave Pay ensures that employees are fairly compensated for their entitlement to annual leave, even if they do not use it before leaving their jobs.

Here’s a table summarising the key differences:

| Feature | End-of-Service Gratuity | Accrued Leave Pay |

|---|---|---|

| Purpose | Financial compensation for years of service. | Compensation for unused vacation/sick leave. |

| Calculation | Based on monthly salary and total service years (half-month vs. full month rule). | Based on daily/monthly salary and unused leave days. |

| Mandatory | Yes, mandated by law. | No, depends on the contract and company policy. |

EOSB for Domestic Workers

According to Article 16 of Resolution 310 of the Council of Ministers dated 07/09/1434, a domestic worker is entitled to one salary after 4 years of service. For instance, if a housemaid or a house driver worked for 12 years, they will get 3 monthly salaries as the EOSB award. Unfortunately, the end-of-service calculator of Saudi Arabia given above would not calculate the EOSB for domestic workers.

Responsibilities and Deadlines

In the context of EOSB, both employers and employees have distinct responsibilities and deadlines to ensure compliance with labour regulations and facilitate a smooth transition upon termination of employment contracts:

Employer Responsibilities

- Providing Information: Employers are responsible for informing employees about their entitlements to EOSB per Saudi labour laws and the terms outlined in their employment contracts. This includes educating employees about the calculation methods, eligibility criteria, and any additional benefits they may receive upon termination.

- Calculation and Payment: Employers must accurately process EOSB payments for eligible employees under labour regulations and contractual agreements. This involves considering factors such as the employee’s length of service, basic salary, and any accrued benefits like unused leave pay. Employers are also responsible for ensuring timely payment of EOSB to employees upon termination of their contracts.

- Compliance with Deadlines: Employers must adhere to deadlines set forth by labour laws or regulatory authorities for processing and disbursing employee EOSB payments. Failure to meet these deadlines may result in penalties or legal consequences for the employer.

Employee Responsibilities

- Understanding Entitlements: Employees are responsible for familiarising themselves with their rights and entitlements to EOSB under Saudi labour laws and employment contracts. This includes understanding the calculation methods, eligibility criteria, and any additional benefits they may receive upon termination.

- Providing Necessary Documentation: Employees must provide relevant documentation or information requested by their employers to facilitate the calculation and processing of EOSB payments. This may include proof of employment tenure, salary details, or other relevant documents.

- Compliance with Procedures: Employees are responsible for adhering to any procedures or requirements set forth by their employers for the smooth processing of EOSB payments. This may involve completing necessary paperwork, attending exit interviews, or fulfilling other obligations as per company policies.

- Timely Notification: Employees should provide timely notification to their employers regarding their intention to terminate employment or retire. This allows employers to initiate the EOSB calculation and payment process within the stipulated deadlines.

Empower Your Employees and Reduce Turnover with Instant Access to Earned Wages!

Qsalary’s innovative Employer-Integrated Earned Wage Access (EWA) solution presents a transformative opportunity for businesses to elevate employee satisfaction and financial well-being. By providing instant access to earned wages, Qsalary empowers employees with greater financial flexibility and stability, reducing financial stress and enhancing morale. This solution fosters a positive work environment and serves as a valuable retention tool, mitigating turnover rates and preserving institutional knowledge within organisations. Particularly during transition periods or while awaiting end-of-service benefits (EOSB), Qsalary’s EWA solution offers a lifeline for employees, ensuring they can meet their financial needs without undue delay or hardship. Ultimately, by embracing Qsalary’s employer-integrated EWA solution, businesses can cultivate a culture of support, trust, and resilience, driving sustained success and prosperity for both employees and the organisation.

Ready to empower your employees and transform your workplace? Take the next step with Qsalary’s Employer-Integrated Earned Wage Access (EWA) solution today! Request a demo now to learn more and start reaping the benefits of a happier, more satisfied workforce.

Related Articles

For more detailed information on Saudi Labour Law and regulations regarding EOSB, you may refer to the following resources:

- Saudi Labour Law

- Regulation of Domestic Workers

- Rights of Domestic Workers

- Demystifying Final Settlement in KSA: A Comprehensive Calculator Walkthrough

FAQs

- What is the Saudi labour law about the end of a contract? The Saudi labour law stipulates regulations regarding the termination of employment contracts, including provisions for End-of-Service Benefits based on factors like length of service and salary.

- What is the End-of-Service for domestic helpers in Saudi Arabia? A domestic worker is entitled to an end-of-service benefit equivalent to one month’s salary if they have been employed by the employer for four consecutive years.

- What is Rule 81 in Saudi labour law? Article 81 in Saudi labour law outlines the situations where an employee can terminate their employment without giving notice and still be eligible for their full legal rights. These situations involve the employer breaching the employment contract or creating a hostile work environment.

- What is Rule 74 in Saudi Labour Law? Article 74 in the Saudi labour law deals with terminating a work contract. It outlines the general grounds for termination by the employer or the employee. It emphasises the need for a written notice with a specified timeframe depending on the salary payment frequency.

This article provides a comprehensive overview of the End-of-Service Benefits in Saudi Arabia, covering all essential aspects, including eligibility, calculation methods, responsibilities, and FAQs. By understanding these details, both employers and employees can ensure compliance with labour laws and secure their financial futures.

End-of-Service Benefits in Saudi Arabia | All Rights Reserved © 2024